Mijn account

European Health & Fitness Market Report 2021 - EBOOK

Some highlights:

Profiles of three large national fitness markets in Europe – Germany, Spain and the UK – are presented. In addition to the detailed profiles of these markets, this report provides brief profiles of other selected markets with information on closure periods and the largest

national fitness operators.

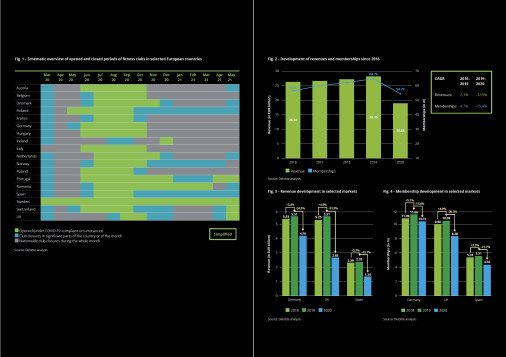

Total number of fitness clubs declined by 1.4 % to c. 62.800. The primary reason for this moderate decrease is likely the financial support many governments provided to companies throughout the pandemic.

Additionally, large chain operators as well as boutique studio's still accounted for a significant number of new club openings in 2020, despite the various lockdowns.

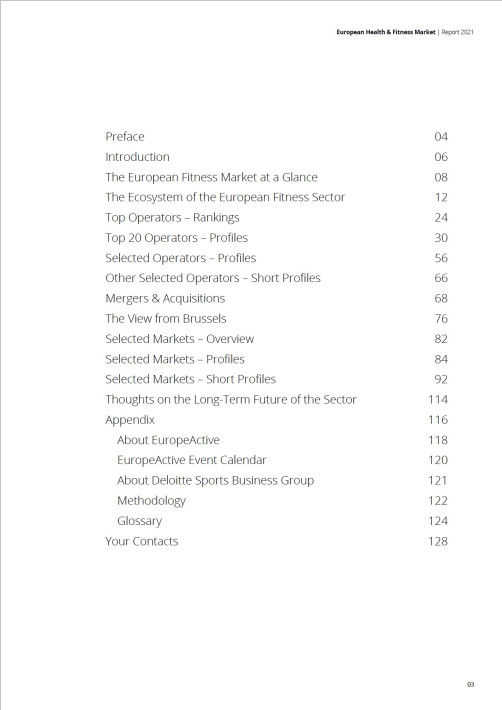

The COVID-19 pandemic caused governments to enforce multiple lockdown periods for fitness clubs, in some cases between 40% and 50% of operational days in 2020. Additionally, in the 1st trimester of 2021, roughly 80-90% of the European club industry was in some kind of a

lockdown.

However, there is light at the end of the tunnel. During the months of May and June 2021, re-openings were possible in most European fitness markets. An overview of the closure periods in European countries can be found in the report.

As in many other sectors, the digitalization and the broadening of the ecosystem has been accelerated in 2020. We have seen significant growth in home fitness equipment and accessories, digital products and services and outdoor. The sector has successfully developed many possibilities to be active anywhere and anytime. More information in the

chapter about the ecosystem.

In the last 15 months, market actors had the chance to double-check their business and recalibrate their strategy for the short and long term, both operationally and in terms of financing. Due to the unexpected prolonged periods of closure, many companies looked into new ways to generate or create access to cash. Sadly, not all companies succeeded in this and were forced to sell their business or close their doors.

The confidence of investors in future growth opportunities and the success of the fitness sector is demonstrated by the large sums that have been invested during 2020 and early 2021 in the various segments of the fitness ecosystem, through existing companies and startups, both online and offline. Quite interestingly a significant portion of this investment is coming from big-tech (notably Apple, Google and Amazon).

More information in the report.

This report will focus primarily on the economic value of the brick-and-mortar fitness clubs, i.e. the indoor segment of the fitness ecosystem, but it is undeniable that the economic importance of home, outdoor and digital fitness has grown exponentially in 2020 and this trend is expected to continue in 2021 and the years to come.